The fact that cryptos can be bought and sold from anywhere in the globe helps to ease some of the liquidity problems that could come up if local governments shut down trading. Due to this, cryptocurrencies, Dollar Cost Averaging are becoming increasingly popular.

Also, investors who worry that a crisis will cause central banks or politicians to get involved in the market may want to move their money to the decentralized crypto market instead. In other words, since cryptos aren’t run by a central authority but instead work on their own, investors can use them to protect themselves from many political risks, making them more appealing.

During the pandemic, many goods and assets lost value. There is a huge impact on bitcoin price due to the covid; in this article, we have discussed the impacts of coronavirus on the price of bitcoin. To know about it, keep reading.

Bitcoin’s rollercoaster ride: The impacts of Covid and Omicron

COVID-19 went from being a local issue to a worldwide problem that affects people all over the world. Investors, doctors, and even the cryptos are all reacting to it. COVID-19 has shocked the whole world. The pandemic has moved quickly and caused problems that no one saw coming. These problems have upset the world economy and changed how the world works.

But the pandemic might be what pushes us toward a cashless society, and now that people are less worried about cryptocurrencies. However, for making safer investments in bitcoin people select bitcoinx software.

- Prices of cryptocurrencies are going down.

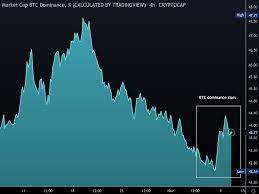

As a result of the widespread coronavirus epidemic in February 2020 in the United States, stock levels fell to their lowest point in the previous two years. This decline in the United States stock market was responsible for wiping out all of 2020’s gains. Bitcoin saw a decline of a comparable magnitude, but its value plummeted to $7,200, wiping out all gains it had made this year.

- CoronaToken

It is a new cryptocurrency, and the people who made it say that the total supply is related to the fact that there are 7.7 billion people in the world. The number of infected and dead coronavirus victims will determine how many of these tokens will be taken away every 48 hours. Also, the developers stated that 20% of the tokens would be given to the Red Cross.

- A New Benefit

Some people interested in cryptocurrency are ecstatic about this development since it means that people will switch from using paper cash to using digital currency to prevent the spread of coronaviruses.

The Unexpected Good: How Covid-19 May Strengthen The Cryptocurrency Market

- The market’s tendency towards volatility is unavoidable. Still, individuals were purchasing cryptocurrencies, which contributed to the popularity of the cryptocurrency market among the general public.

- In March of 2020, the costs were cut in half, reaching a low of $3,780 before continuing their downward trend. Since then, Bitcoin has amassed an incredible amount of money and popularity around the planet.

- The excessively euphoric sentiments that have permeated the market have been largely responsible for the recent surge in the value of Bitcoin and altcoins, which broke a number of previously held records.

A relatively lesser-known crypto token named after the Greek letter Omicron noticed its price rise more than ten times in a matter of two days, outperforming leading virtual currencies such as Bitcoin and Ethereum. This happened shortly after the WHO announced the name of the Covid-19 variant of concern.

Conclusion

So, these were some important points you needed to know being a Bitcoin investment enthusiast. The Covid-19 pandemic caused insecurity all around the world. As a result, there will be a decline in the value of cryptocurrencies during the first few months of 2020. However, as the year progressed, the value of cryptocurrencies began to increase.

This was due to several factors, including the fact that PayPal began accepting Bitcoins as a form of payment, the law of demand and supply, and the fact that paper currency would be more likely to facilitate the spread of the covid in comparison to digital currency. The G20 ministers should take more notice of this effective approach in terms of international regulations pertaining to cryptocurrency.